Book Review: The Art and Science of Real Wealth by Bollachettira Dhyan Appachu

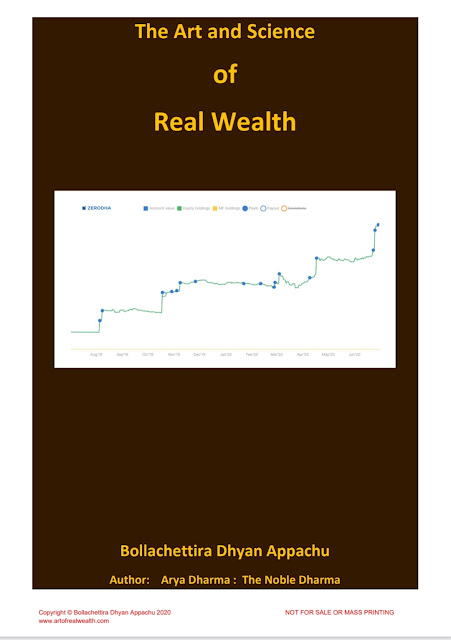

Title: The Art and Science of Real Wealth

Author: Bollachettira Dhyan Appachu

Genre: Finance, Non fiction

Pages: 103

This is my second book by Bollachettira Dhyan Appachu after his 'Arya Dharma'. This is about finance with some really eye opening advice. I think of investing money from time to time and I feel almost everyone does the same so this is a must read for all.

To start with do you know the difference between an investor and speculator?

To become good in speculation, one has to overcome 4 things: ignorance, fear, hope, greed. e only way to conquer fear, hope and greed is by the sincere and sustained practice of Dhyan to achieve Samathvam. Speculation is a continuous learning process. It's both an art and science. Even after 26 years the writer is not perfect.

He has seen downfall till the recent past until early 2018.

He figured if even a world class speculator like Jesse Livermore did break his rules and make mistakes, he

also have made the same mistakes, but hopefully he is learning not to repeat them in the future.

I really like the way he addresses things:

The Managed Money are the wolves.

The Dealers are the shepherds and the Producers are the sheep – they can fight the wolves and direct the sheep.

Shepherds can even direct the sheep off the cliff and the sheep will blindly jump.

But sometimes the sheep just jump over the fence and run away and escape and leave the shepherd and wolves chasing after them.

The most exciting market in the world is the Shanghai Composite (SSEC).

The Shanghai Composite (SSEC) is a good gamblers most orgasmic wet dream and a clueless gamblers worst nightmare.

The Shanghai Composite (SSEC) can fall 4% in a day and rise 2% the next day.

Can you imagine the scale and magnitude of profits or losses that can be made by trading on the Shanghai Composite (SSEC)?

However do not speculate in the commodities and currency markets with not more than 0.5% of your net liquid income (net cash only, not land, gold etc), after all expenses, including your planned foreign world tour with your wife, mistress or toy boy whichever may be the case.

According to him, real Estate is the most overrated “investment” as of 2020 especially in developing countries like India, which he always calls Bharat.

Few rules on

Short Term Trading

This form of trading covers hourly to daily to weekly to monthly and applies to currencies but can also be applied to other short term instruments like commodity and equity and futures and options.

As far as possible never speculate in equity and equity index futures and options. It is just a waste of time, money, and resources.

Only writers of these options consistently make money. Options buyers lose money 999 times out of

1000.

Never write options with your own hard earned money, this is only done by people who are using OPM

(Other People’s Money) and people using OPM are only found among the Wall Street/Dalal Street

Long Term Trading

This form of trading covers a period 1 to 5 years or more even upto 10 years.

High Risk Investing - The Art of ICU Lottery Ticket Speculation

Due to dumb luck, or maybe some talent,he is not sure which, he has been a reasonable success at ICU Lottery Ticket Speculation.

ICU Lottery Ticket Speculation means investing in almost dead stocks or stocks which have fallen significantly from their highs.

Death or Recovery.

This is a risky and extremely complicated method of speculation.

The odds of success even among the most sophisticated of ICU Lottery Ticket speculators is less than 15%.

But if even one of that 15% clicks, you can make more than 10+ times your money when the stock recovers.

Some of his words to swear by:

Do not catch a falling knife.

Do not mortgage your grandfather’s house and wife’s jewellery to do ICU lottery ticket speculation, because there is a very good chance you will no longer have the winning ICU lottery tickets, grandfather’s house and even your wife.

With all this, I end my gist of this useful book. I could go on and on as every piece of information is worth learning.

This is my second book by Bollachettira Dhyan Appachu after his 'Arya Dharma'. This is about finance with some really eye opening advice. I think of investing money from time to time and I feel almost everyone does the same so this is a must read for all.

To start with do you know the difference between an investor and speculator?

To become good in speculation, one has to overcome 4 things: ignorance, fear, hope, greed. e only way to conquer fear, hope and greed is by the sincere and sustained practice of Dhyan to achieve Samathvam. Speculation is a continuous learning process. It's both an art and science. Even after 26 years the writer is not perfect.

He has seen downfall till the recent past until early 2018.

He figured if even a world class speculator like Jesse Livermore did break his rules and make mistakes, he

also have made the same mistakes, but hopefully he is learning not to repeat them in the future.

I really like the way he addresses things:

The Managed Money are the wolves.

The Dealers are the shepherds and the Producers are the sheep – they can fight the wolves and direct the sheep.

Shepherds can even direct the sheep off the cliff and the sheep will blindly jump.

But sometimes the sheep just jump over the fence and run away and escape and leave the shepherd and wolves chasing after them.

The most exciting market in the world is the Shanghai Composite (SSEC).

The Shanghai Composite (SSEC) is a good gamblers most orgasmic wet dream and a clueless gamblers worst nightmare.

The Shanghai Composite (SSEC) can fall 4% in a day and rise 2% the next day.

Can you imagine the scale and magnitude of profits or losses that can be made by trading on the Shanghai Composite (SSEC)?

However do not speculate in the commodities and currency markets with not more than 0.5% of your net liquid income (net cash only, not land, gold etc), after all expenses, including your planned foreign world tour with your wife, mistress or toy boy whichever may be the case.

According to him, real Estate is the most overrated “investment” as of 2020 especially in developing countries like India, which he always calls Bharat.

Few rules on

Short Term Trading

This form of trading covers hourly to daily to weekly to monthly and applies to currencies but can also be applied to other short term instruments like commodity and equity and futures and options.

As far as possible never speculate in equity and equity index futures and options. It is just a waste of time, money, and resources.

Only writers of these options consistently make money. Options buyers lose money 999 times out of

1000.

Never write options with your own hard earned money, this is only done by people who are using OPM

(Other People’s Money) and people using OPM are only found among the Wall Street/Dalal Street

Long Term Trading

This form of trading covers a period 1 to 5 years or more even upto 10 years.

High Risk Investing - The Art of ICU Lottery Ticket Speculation

Due to dumb luck, or maybe some talent,he is not sure which, he has been a reasonable success at ICU Lottery Ticket Speculation.

ICU Lottery Ticket Speculation means investing in almost dead stocks or stocks which have fallen significantly from their highs.

Death or Recovery.

This is a risky and extremely complicated method of speculation.

The odds of success even among the most sophisticated of ICU Lottery Ticket speculators is less than 15%.

But if even one of that 15% clicks, you can make more than 10+ times your money when the stock recovers.

Some of his words to swear by:

Do not catch a falling knife.

Do not mortgage your grandfather’s house and wife’s jewellery to do ICU lottery ticket speculation, because there is a very good chance you will no longer have the winning ICU lottery tickets, grandfather’s house and even your wife.

With all this, I end my gist of this useful book. I could go on and on as every piece of information is worth learning.

Comments

Post a Comment